Deferred Interest Vol. 24

Not all that glitters is profitable

Hey Everyone,

I am staring down the final few weeks before a two-week European adventure. My partner and I somehow ended up with three weddings on the continent in one month. I’m excited, grateful, all the things, but my big question is…who is paying for all of this? Because despite the flood of #europeansummer content your social feeds, most people can’t just pick up and leave the country without hesitation.

Which brings me to the beauty of side hustles. Side hustles have been my financial buffer for everyday expenses, tuition, vacations, etc. I’ve seriously stepped up my side hustle practice this year, and it’s helped me pay off my loans and create a bit more financial breathing room.

I’m a big fan of Leland if you’re looking to monetize your professional skills. It’s an online coaching platform that connects clients with thousands of career and admissions experts. I coach across investment banking, the MBA process, and venture capital, but the categories range from LSAT prep to product marketing to management consulting. While Leland definitely takes its cut, having clients come to you instead of constantly sourcing your own makes it worth it. I highly recommend if you want or need more schedule flexibility.

Let me know if you have any questions about the platform!

If you enjoy Deferred Interest, please drop a like 🤍 (and if you’re feeling frisky, a comment) below. Your engagement brings this content to more readers. I appreciate you!

Quick Hits

Novo Nordisk launches $499 Ozempic & Wegovy with GoodRx

Following its telehealth Wegovy partnerships launched earlier this year Novo has partnered with GoodRx, the leading platform for medication savings in the U.S., to provide all strengths of Ozempic and Wegovy for $499/month. This collaboration significantly lowers the price available on GoodRx for two of the most in-demand GLP-1 medications nationwide, expanding access for those who lack adequate insurance coverage. This marks the first time Ozempic has been made available to patients at this self-pay price.

Fed Chair Jerome Powell hints at upcoming rate cut

In his Jackson Hole speech Jerome Powell signaled the central bank may finally start trimming rates, as soon as next month. While he stopped short of announcing a cut outright, Powell cited rising risks to the labor market and a “shifting balance” in economic conditions as justification for easing policy. If you’ve been holding off on financing a car, buying a home, or paying down credit card debt, lower rates could offer some breathing room. It’s not 2020 levels, but any drop is welcome when borrowing has gotten this expensive.

Estée Lauder sales fall as the beauty giant braces for tariff hit

Estée Lauder reported an 8% drop in annual sales, with softness across all categories and geographies, from skincare to haircare, and from the U.S. to China. The company is projecting a $100 million tariff hit next year and still wrestling with sluggish consumer sentiment in the West. Despite the dip, execs say they're optimistic about a return to growth in 2026. Between rising costs and cautious shoppers, even prestige beauty is feeling the macro pressure, and this could affect what’s passed onto end consumers.

Some Brands Shouldn’t Be Public

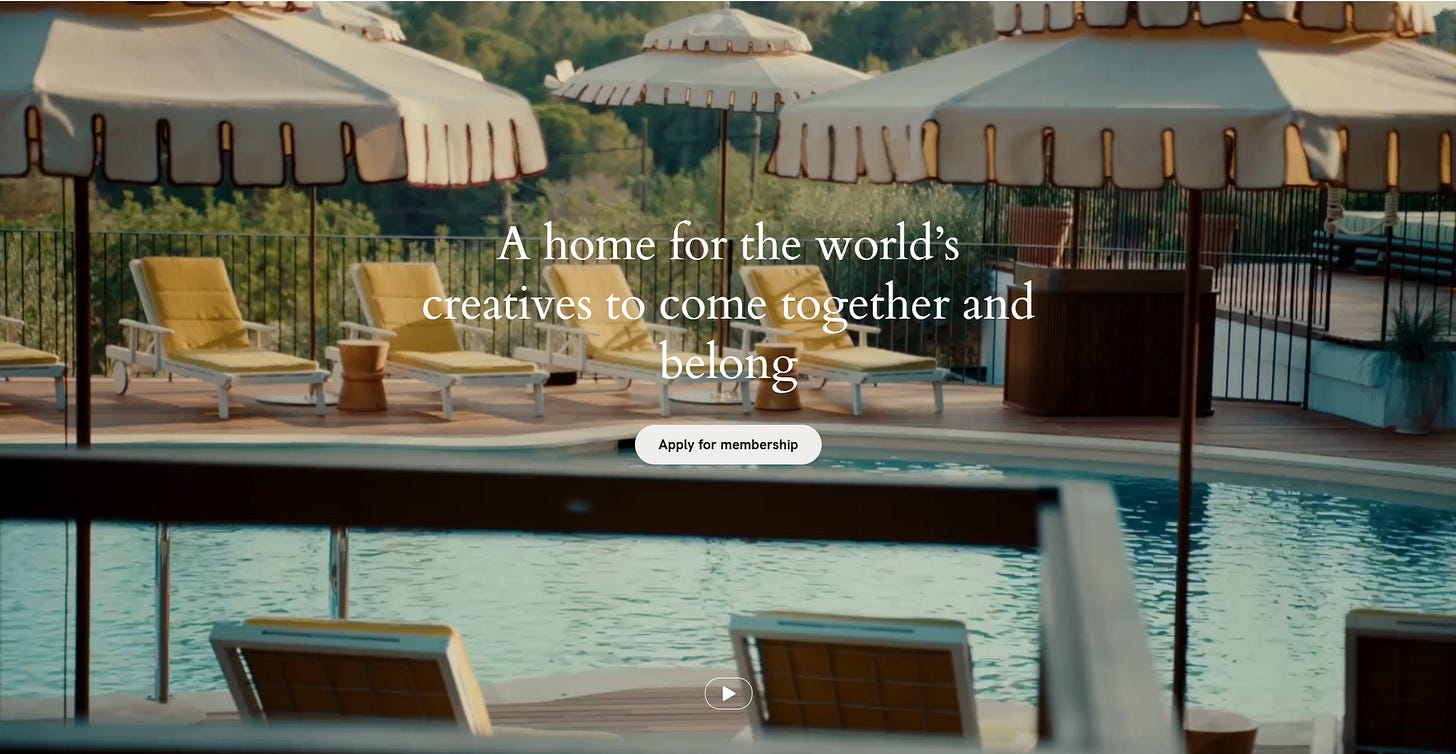

Soho House goes private in $2.7B deal

The stock market cares about quarterly earnings. Members care about curation, service, and cachet that lives up to a hefty annual fee. When those two priorities conflict, you end up with a $2.7B take-private transaction.

The irony of this outcome is that it’s very on brand for a members-only club. To me, Soho House never seemed like a natural fit for the public markets. The company’s appeal has always rested on prestige, scarcity, and brand ethos—intangibles that are nearly impossible to quantify let alone scale, under the scrutiny of public shareholders.

What’s happening

Soho House just announced a $2.7B deal to go private. The buyer is an investor group led by MCR Hotels. Once the deal closes, Soho House shares will be delisted, and the company will no longer be publicly traded.

The offer price of $9/share represents an 83% premium to the pre-offer stock price but still sits well below the $14 IPO price from 2021. Whether you made money on this deal depends entirely on when you bought in.

The players

Soho House: A global membership platform with 46 Soho Houses, 8 Soho Works clubs, and various hotels and outposts like Scorpios in Mykonos (which was probably on your FYP all summer). As of December 29, 2024, membership stood at roughly 271,500.

MCR Hotels: The third-largest hotel owner-operator in the United States. While the bulk of MCR's portfolio consists of branded mid-priced hotels like Homewood Suites and Residence Inn, in recent years it has begun purchasing higher-end properties. Its well-known properties include TWA Hotel at JFK, The High Line Hotel and the Gramercy Park Hotel. This deal continues their shift into premium lifestyle territory.

Ashton Kutcher: No longer just the face behind your favorite rom-com or MTV reality show (am I aging myself?). Kutcher is a major tech investor both individually and through his VC funds, Sound Ventures and A-GRADE Investments. Sound Ventures manages over $1B and counts Airbnb, Spotify, Uber, and OpenAI among its investments. Kutcher will bring strategic and tech-focused value-add to the board.

An executive from MCR and Kutcher will be joining the board as a stipulation of the deal.

How we got here

Soho House was founded in 1995 by Nick Jones as a chic gathering spot for London creatives. It grew steadily, and somewhat mysteriously, for years, relying on word of mouth and scarcity tactics.

To date, it’s the only private membership platform with a global presence. Its global footprint and aura of selectivity have fueled a waitlist of more than 112,000 applicants.

Even Annabelle Bronstein couldn’t sneak into the Soho House pool in SATC season 6. IYKYK.

That episode aired 22 years ago, right after Soho House had opened its first club in North America. Since then, they’ve opened 15 more houses on this continent alone.

But going public in 2021 marked a strategic inflection point. The company raised $420M at a $2.8B valuation but faced immediate tension between its members and public shareholders. The question quickly became, how do you scale at the level a public company requires without diluting the brand?

Cue new financial and operational challenges.

Member dissatisfaction mounted, with concerns ranging from overcrowding and eroding service standards to a shift from curated intimacy toward mass-market commercialism. Membership growth was there, but the profitability was not. The company in its entire existence has never posted a full-year profit, despite quarterly progress.

By 2024, short-seller attacks amplified existing headwinds, intensifying scrutiny of the business model. Glasshouse research, an anonymous short-seller firm, released a brutal 31-page report calling Soho House “a company with a broken business model and terrible accounting.” They claimed the stock was heading to $0. The report alleged that debt-fueled expansion was also catching up to them.

The company denied the claims, but the narrative stuck. The stock dipped as low as $4.60, down 67% from IPO highs. Eventually the path forward became clear, taking Soho private.

What a take-private means

A take-private transaction is when a company that’s publicly traded on the stock market decides (or is persuaded) to leave Wall Street and go back to being privately owned.

Right now, a company like Soho House has shares that anyone can buy or sell on a stock exchange. In a take-private deal, a group of investors, often a company’s own management team plus a private equity firm, offers to buy up all those shares from the public at a set price.

Once the deal is done, the stock stops trading, and the company is “private” again, owned by just that small group of investors instead of thousands of public shareholders.

For Soho House, this may be a chance to restore some of its mystique. Less pressure to pump up membership numbers at the expense of brand integrity.

Why would a company go private after being public?

1. Escape public market pressures

Soho House’s share price is ~30% below its first trading day post IPO

Going private lets the company focus on long-term strategy without the constant anxiety around stock market movements and earnings releases

2. Restructure away from the public eye

Big changes (layoffs, cost cuts, brand repositioning) are easier when you’re not answering to short-term shareholders

Away from public scrutiny, new owners like MCR and Ashton Kutcher can streamline operations and reframe the business without undue focus on headlines

3. Strategic partner benefit

MCR brings hospitality expertise (e.g., TWA Hotel, Gramercy Park Hotel) and operational discipline that balance Soho House’s creative culture with profitability

Kutcher and his fund bring tech + consumer experience, adding credibility and potential digital/experiential innovation

This consortium can reposition Soho House as a premium lifestyle brand with tighter execution

4. Shareholder Value (Even If Mixed)

At $9/share, the deal is an 83% premium to the pre-offer trading price, rewarding some investors

Early IPO investors still lose money, but the deal provides an exit and stabilizes valuation, versus leaving the company vulnerable to further declines or even bankruptcy rumors

There is a downside for regular investors…you don’t get to keep owning the stock. You’re cashed out at the deal price, whether you wanted to sell or not.

Other notable take-private deals

Walgreens (2025) – Taken private by Sycamore Partners

Panera Bread (2017) – Bought by JAB Holding for $7.5B

Buffalo Wild Wings (2017) – Acquired by Arby’s (backed by Roark Capital).

Dell Technologies (2013) – Michael Dell and Silver Lake bought it for $24B in one of the most famous tech buyouts.

Why this deal is interesting

In New York, membership clubs are proliferating. Every week it feels like a new “exclusive” spot opens its doors. The Soho House saga forces the question; how big can you really get before value starts to fall off? At some point, exclusivity and scale inevitably clash.

There’s also the IPO piece. Going public is often treated like the ultimate victory, but it’s really just the start of a new stage, one that comes with its own set of requirements and trade-offs. Not every company is built for the public markets. This is how I feel about Soho House. It just feels like they never should have gone public in the first place. What do you all think about this deal? Drop your thoughts in the comments.

Save for Later

This week’s newsletter was supposed to be pt. 2 of my Martha’s Vineyard recap, but I was too excited about the Soho House deal. I’ll be sharing the last part of my event run down in a separate post this week. Stay tuned.

Thanks for making it to the end! Subscribe to receive future Deferred Interest newsletters directly in your inbox

That’s all for this week! Thanks for reading.

X

Jamie

Thanks for sharing this, Jamie! Your deep dives are always comprehensive, thoughtful, and easy to understand. Referencing SATC and IPOs in the same newsletter is what makes Deferred Interest one of my favorite reads!