Hey Everyone,

Administrative outsourcing is no longer exclusive to the rich, and if you’re not leaning in you’re undervaluing your own time. Last year, I was at a women-in-consumer VC panel at JP Morgan, and Louisa Schneider, the Founder of Rowan, was asked how she manages life as a mother and business owner. She playfully responded, “Outsource as much as you can.” Many of the women in the audience laughed, knowing exactly what she was talking about.

While I’m not a mother or a CEO, the mindset still resonates. We’re all trying to do the impossible every day, and going that alone is increasingly unrealistic. Some people have access to full-time help—nannies, in-person assistants, drivers (a girl can dream). Those options are expensive, and often out of reach.

But for career-driven young professionals like me, small-scale outsourcing has become incredibly accessible, thanks to technology and the gig economy.

I may not be able to afford an assistant, but…

I can pay $99/year for unlimited Instacart delivery, reclaiming 12+ hours a month I’d otherwise spend in the lethal Trader Joe’s line

I can book a local cleaner via TaskRabbit or Handy, sparing me the weekly tradeoff between productivity and cleanliness

I can spend $20/month on ChatGPT Plus, which I lean into for everything from recipe generation to newsletter support

Here’s the thing. Your time is likely worth more than what many of these services cost. If your hourly rate, explicit or implied—is higher than $10–15, outsourcing is more efficient than indulgent. Reinvest that time into your career, your wellness, your Substack, or just a moment of quiet.

Honestly grocery shopping in person is not my ministry. And I’m okay with that.

Have you outsourced anything recently that made your life way easier? Drop a comment—I’m always sourcing ideas.

If you enjoy Deferred Interest, please drop a like 🤍 (and if you’re feeling frisky, a comment) below. Your engagement brings this content to more readers. I appreciate you!

Calling All Early-Stage Female Founders

Dream Ventures Accelerator is officially enrolling for Summer School: Fundraising Edition, a no-fluff, high-impact accelerator.

If you’ve ever asked “what type of capital is right for me?” or “how do I actually raise it?”, this is your moment and we scored a promo code for our community ;)

Think: poolside progress, pitch practice, and a powerful community at your back.

Use the code JAMIE150 for $150 off!

I have been collaborating with the Dream Ventures Accelerator for two years now, and I highly recommend this program for early-stage female founders contemplating their approach to fundraising.

Quick Hits

Design software company Figma goes public at $19.3B valuation

Figma is a design tool used to create, share, and test designs for websites, mobile apps, and other digital products and experiences. After its $20B planned sale to Adobe fell through in 2022, Figma priced its IPO just shy of that valuation. This was one of the most anticipated IPOs of 2025, with demand for shares 40x (!!) oversubscribed. Shares were priced at $33 and are now up ~250%, closing Friday at $113.94.

Generous Brands to acquire Health-Ade Kombucha for a rumored $500M

Generous Brands, the PE-backed company behind Bolthouse Farms, Evolution Fresh, and SAMBAZON will acquire the kombucha maker to expand its premium beverage empire. Health-Ade has been around since 2012 and generates ~$250M revenue annually. No official financial terms were disclosed, but sources like the Wall Street Journal reported an expected $500M valuation.

The viral Erewhon x Vacation smoothie is back

Erewhon, an LA-based specialty grocer, has become notorious for it’s custom smoothies, which frequently are in collaboration with notable celebrities like Hailey Bieber, Sofia Richie, Travis Scott, etc. Erewhon originally partnered with lifestyle SPF brand Vacation back in Summer 2024 to bring a sunscreen-inspired smoothie to market. Lucky for us, the drink is back for a limited time, and even lower price vs. other featured blends.

Outdoor Voices, the Comeback Kid

Something was clearly up.

A few weeks ago, Outdoor Voices (OV) wiped its Instagram grid and unfollowed everyone except one account, Ty Haney. The founder and former CEO had exited the company back in 2020, so naturally, fans were on high alert.

Turns out, OV, under the ownership of Consortium Brand Partners (Draper James, Jonathan Adler), has brought Haney back into the business as Founder, Partner, and Co-Owner. The ownership split hasn’t been disclosed.

Twelve years since its founding, five years post exit…why now? Why her?

The more I investigated the story, the more I felt OV was simply Glossier’s athletic cousin. Both were born in a time when DTC was conflated with tech business models, and capital was, to put it kindly, abundant. The obsession with growth-at-all-costs didn’t exactly play well with the realities of selling physical products.

By now, we can tell DTC rise-and-fall arcs with our eyes closed. But in the context of Ami Colé shuttering and Phlur being acquired, OV re-emerging raises two very real questions:

1. Tactically, what does a rebrand even look like when you peaked 8 years, and countless competitors, ago?

2. Which brands get a second shot, and who decides?

A Brand Made for the Moment, Until it Wasn’t

OV once stood as a beacon of the direct-to-consumer boom—a color-blocked, pastel antidote to performance-obsessed Nike.

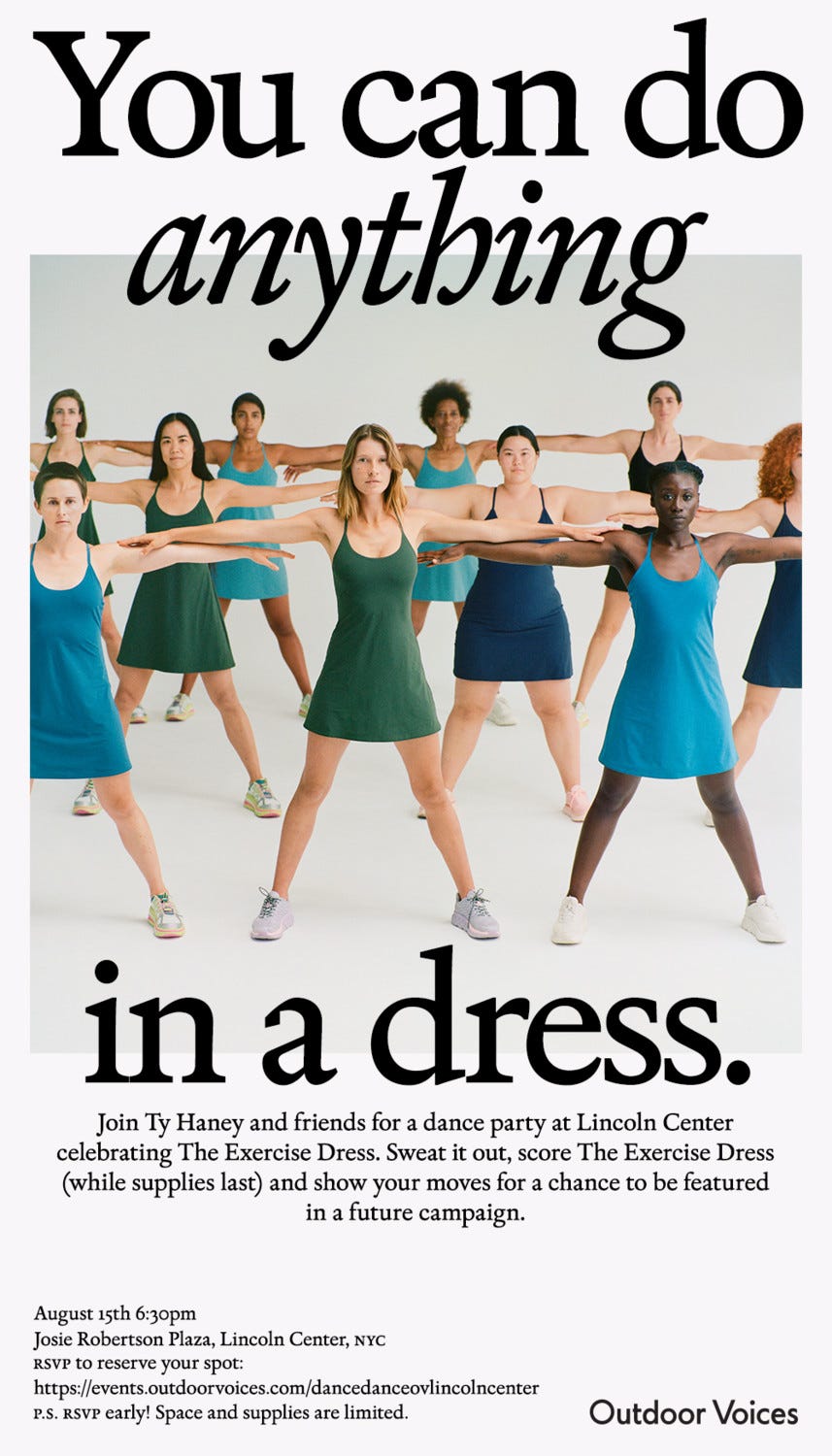

Founded in 2013 by a 24-year-old Haney, OV built its identity around the tagline “Doing Things,” a refreshingly non-intense approach to movement. It celebrated walking your dog or running errands as equally worthy forms of movement. At its peak, it had a cult following, with the Exercise Dress as its cultural North Star.

In-person activations and community were core to growth. Social feeds were flooded with user-generated #doingthings content.

Wellness had evolved into a lifestyle rather than just a category, and that mentality permeated millennial wardrobes.

But we now know how the story plays out for many of these brands.

The Slow Unraveling

Emily Sundberg laid out a play-by-play of the brand’s timeline, charting its quick rise, and fall in just as much time.

Looking at 2013-2018, the brand is seemingly thriving. In 2019, The New Yorker projected success for Outdoor Voices akin to Under Armour’s or Lululemon’s.

In August 2017 the brand closed a $9M convertible note from Drexler Ventures, Mickey Drexler’s investment firm. Drexler also became Chairman of the board. For a retail start-up, having an industry titan like Drexler (former CEO at J. Crew, Gap, Ann Taylor) is vision board worthy. If someone like Drexler is willing to put forth capital and join the board, it’s a strong signal to the market.

In March 2018, Outdoor Voices raised a $34M Series C led by Google Ventures, bringing funding to ~$64M and its valuation to $110M.

While everything looked peachy externally—Drexler on the board, investment from Google Ventures, the exercise dress became a defining product of the era—the business was unraveling behind the scenes.

Haney’s leadership was under scrutiny. Anonymous employee emails circulated to the board and executives. Meanwhile, spending decisions bordered on parody. According to the New York Times, retail stores spent the below in 2018:

$22,000 on Maison Louis Marie No. 04 candles

$45,000 on fresh flowers

$36,000 Topo Chico bottled water

Then came the tension between Drexler and Haney. Board problems can be the kiss of death for founders, especially when cap tables dilute their power. Haney lost voting control through OV’s big fundraises, and when the company raised a down round at $40M, she was pushed out as CEO (while on maternity leave!). She eventually resigned completely.

In more recent years Haney has been more vocal about what went wrong, namely raising too much money and getting priced out of her own company.

While the company went further downhill in Haney’s absence (along the way there was a random Disney collab?) she wasn’t shy about sharing her thoughts online.

Back to our questions…

So how did we get from there to a private equity firm Consortium Brand Partners purchasing the business and re-installing Haney as Partner, Founder, and Co-Owner?

Back to our earlier questions:

Tactically, what does a rebrand even look like when you peaked 8 years, and countless competitors, ago?

Which brands get a second shot, and who decides?

This will be an evolving case study, but some early questions to sit with:

Is OV’s return even about the product, or just who the product was made for?

Does the “It Girl” demographic (and we know exactly what that’s coded for) have more brand lifelines built in?

Why do some brands (like Ami Colé) get a four-year runway, while others, like Phlur, manage to relaunch, rebrand, and even get acquired?

I don’t have the answers (yet), but let’s track OV’s relaunch together. Hopefully we start to answer our growing list of questions on who gets to fight another day and who gets forced out.

Save for Later

I just joined the All Raise VC Champions program for junior partner/principal level investors! All Raise is a must-know non-profit organization dedicated to accelerating the success of female founders and funders in venture capital. They do amazing work bringing together and empowering female investors. Finding effective mentors and sponsors has been pretty challenging vs. my experience in investment banking and I’m hoping this program helps shift that for me. The list of potential mentors is tier-1, I’m excited to keep you all posted!

That’s all for this week! Thanks for reading.

X

Jamie